Tax Tokens and Cryptocurrency

In this article, you will be able to learn about tax tokens and cryptocurrency. A tax token is basically a tax that is issued to the people so that they can avoid themselves from paying extra tax. There is a considerable evolution in the laws about cryptocurrency and tax tokens. You can earn a massive profit by utilizing cryptocurrency and you will also pay tax for it. The system of tax tokens for cryptocurrency was outlined from 2014 to 2021. Internal Revenue Service outlined this system of taxation.

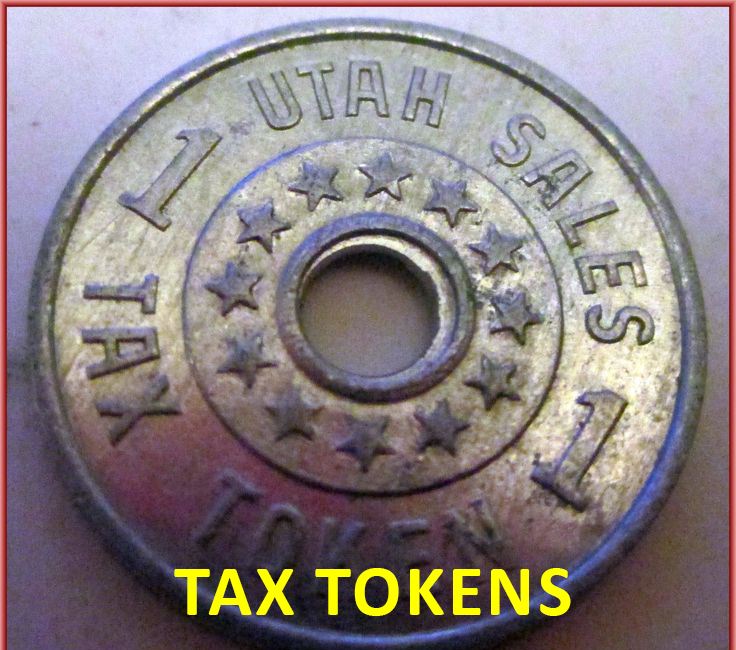

What are tax tokens?

Tax tokens are essential vouchers that represent fractional amounts of the American penny. The main reason for issuing tax tokens is to help people to avoid overpaying sales tax.

Perception of Tax Tokens and Cryptocurrency

It is an analysis that more than 10,000 e-mails were sent to different people who were active members of transacting cryptocurrency. They were asked to pay tax tokens for the profit they earned by the utilization and the transaction of cryptocurrency. Tax token is paid to the Government. It is the responsibility of The Internal Revenue Service to send e-mails to the taxpayers. This analysis was conducted in 2019. If people hide their actual income, they can face different punishments like criminal prosecution, penalties, etc. Internal Revenue Service issues these warnings.

What kind of investment is cryptocurrency?

Cryptocurrency is generally a digital currency. You can earn a considerable profit from it. That is why the cryptocurrency is the best for financing. It can be a bit unsafe but you can also earn a profit from it. You can also invest in those companies that do work related to cryptocurrency to gain profit.

Mining Cryptocurrency

Cryptocurrency miners verify transactions in cryptocurrency and add them to the blockchain. They are compensated for it. Their compensation is taxable as business income. They are also eligible to deduct the expenses.

Is tax token on cryptocurrency legitimate or not?

It is a common question that is asked by everyone who wants to invest in cryptocurrency, whether tax token on cryptocurrency is legitimate or not. The answer is that it is all up to the policies of a country. It is all up to the country to make it legitimate or not. It is research that in America, tax token on cryptocurrency is legitimate. On the contrary, if you talk about China, tax token on cryptocurrency is not legitimate. It is all up to the policies of a country.

Can you distinguish any difference between cryptocurrency and Bitcoin?

Cryptocurrency and bitcoin both are digital currencies. The common difference between Bitcoin and cryptocurrency is that bitcoin utilizes cryptocurrency. On the other hand, cryptocurrency is used for transactions, investments, and gaining profit. This is a common difference between bitcoin and cryptocurrency.

Pros of tax tokens

- Tax tokens are authentic and provide verified ownership on the blockchain.

- Tax tokens empower the market for new beginners.

Cons of tax tokens

- Tax tokens are speculative investments.

- There is a high rate of fraud and scams.

What are the different categories of cryptocurrency?

According to a crypto research company, there are basically four categories of cryptocurrency. These categories include:

- The first category of cryptocurrency is DeFI.

- The second category of cryptocurrency is NFT.

- The third category of cryptocurrency is utility tokens.

- The fourth category of cryptocurrency is storing tokens in the form of litecoin and bitcoin.

These are all the significant categories of cryptocurrency.

What is the reason behind the demand for cryptocurrency?

It is generally known as a digital currency. It can give you a considerable profit. It is mainly a business that can give you profit and can secure your future. When you purchase and exchange cryptocurrency, you also get a profit. It has become the best business for the young generation. They like to invest in it. The high ratio of gaining profit is the central reason behind the demand for cryptocurrency.

Which is the most demanding cryptocurrency all around the world?

Bitcoin is the most demanding cryptocurrency all around the whole world.

What is the magnitude of cryptocurrencies in the world?

According to research, there are almost 12, 000 cryptocurrencies in the whole world. There is a fantastic fact that this number is increasing date by a day. In the time period of 2021, this number was increased twice per month.

What are the cons of cryptocurrency?

The cons of cryptocurrency include:

- It is a bit difficult to understand cryptocurrency. It is very time-consuming.

- You have to pay a lot of effort. It is a highly volatile investment. You can also face security risks.

What is the value of tax tokens on different cryptocurrencies?

It all depends on the policy structure of a country. The tax token rate of cryptocurrency profit, and investment will be identical in one country. However, it can be different in another country. The tax token rate of cryptocurrency varies from one country to another country.

Do you pay tax tokens on each transaction of cryptocurrency?

You do not pay tax tokens on each transaction of cryptocurrency. However, you pay some amount of allowance for each transaction. This transaction fee varies from 0.1% to 1% on each transaction. Sometimes, you also get a commission.

Is it possible not to pay tax tokens on the transaction of cryptocurrency?

It can be possible but you will have to consult with a professional in cryptocurrency for this purpose. He will guide you through all the procedures.

At which time do you pay tax tokens on cryptocurrency?

Whenever you gain a profit by utilizing cryptocurrency, you will have to pay a tax token. It is the responsibility of The Internal Revenue Service to send you details about your tax tokens.

Some important points about tax tokens and cryptocurrency

- If you sell cryptocurrency at a profit, you owe capital gains on that profit, just as you would on a share of stock.

- If you use cryptocurrency to buy goods or services, you owe taxes on the increased value between the price you paid for the crypto-coin and its value at the time you spent it.

- If you are a cryptocurrency miner, your income gained from mining counts as business income. If you accept cryptocurrency as payment for goods or services, you must report it as business income.

Apart from this if you are interested to know about Crypto Tax Software then visit our ARTICLE category.

FAQS

Which cryptocurrency can give you the highest percentage of profit?

Bitcoin is one of the cryptocurrencies by which you can get the highest percentage of profit.

Does the tax token ratio on cryptocurrency identical in each country?

kens differ from one country to another. It all depends on the government policies about tax tokens on the cryptocurrency of a particular country.